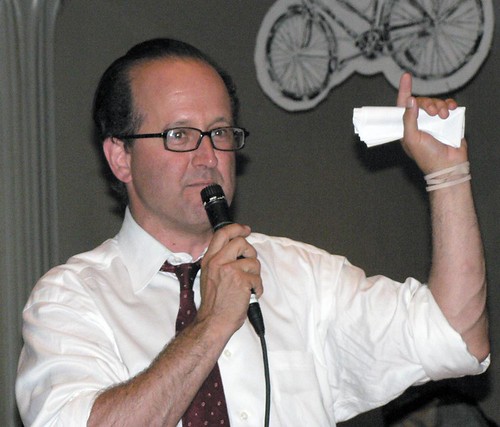

Labor writer and activist Jonathan Tasini

Jonathan Tasini has written a simple and compelling piece about NY Gov. David Paterson’s call for pension givebacks for state employees. Here’s the core of Tasini’s argument:

We could wipe out the budget deficit–or, certainly trim it down to something trivial–by raising taxes on the very wealthy and going back to a more progressive taxation system that we had in the 1970s. You know this: if the state replaced the existing rate structure (consisting of 5 brackets with rates ranging from 4.0 to 6.85%) with one consisting of 14 brackets with rates ranging from 2.0 to 15.0%, we could bring in $6-7 billion more, and perhaps as high as $11 billion.

Under this plan, 95 percent of the state’s taxpayers—95 percent of the people—would receive a tax cut. Like the proposals championed by President-elect Barack Obama, a more progressive taxation system would be easing the burden on the people who are the most at risk in our economically troubled times. The top one percent of taxpayers—whose average income is $2.685 million—would see their taxes go up about 5.4 percent. The four percent below that top one percent—those people whose average income is $326,000—would have their taxes rise 1.4 percent.In fact, the top five percent would have their dues burden slightly reduced because higher state taxes would lower their federal obligations.

Everyone else would realize a reduction in their taxes.

I highly recommend the rest of the article, too.

Leave a Comment